Because of our neutral, impartial and third party position, we get a lot of questions about mortgage payments and loan amortization from our clients, even though much of the information can be obtained from the web and from lenders and mortgage brokers. We’d like to preserve our neutrality while presenting our views about these subjects in 3 ways:

For those who hate numbers and charts (1)

For those who are comfortable with numbers and charts (2)

and For those who are math savvy (3)

1. For someone who is frustrated and intimidated by numbers and charts, we came up with a metaphor to show how the concept of mortgage works.

Part 1 video explains the concept:

Part 2 shows how you can save money and reduce mortgage years by making additional manageable payments.

2. For someone who doesn’t mind reading numbers and charts, we have provided a simple Mortgage Calculator with video attachments to show how to use it.

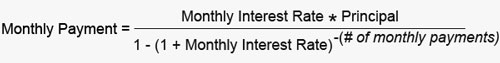

3. For someone who is math savvy and wants to know the formula to calculate the mortgage payment, we have that for you.

For example:

for a 30 year, $250,000 home loan with a fixed yearly interest rate of 5.00%,

the Monthly Interest Rate is .42% (5.00%/12),

the Principal is $250,000,

the # of monthly payments is 360 (30 years * 12 months/year),

the fixed Monthly Payment is $1,342.05