One of the most prevalent types of check scams is the passing of fraudulent checks to unsuspecting and naive sellers who post personal stuff for sale on public sites.

Here is the setup:

- The sale piece is usually an item of higher value, in the mid hundreds, probably less than $1,000, but requires special shipping.

- You get a text or email from an “interested party” who wants to buy what you are selling

- The check you receive is either a third party check or a financial institution issued check, like an Official Check or Cashier’s Check

- They are willing to pay you considerably more than the asking price to “cover shipping charges for the item”

- Their only request is that once the check clears and item is shipped, refund the unused balance to the them

Here is the scam:

- You deposit their check, giving it a few days to clear, and then ship the item and send your check back with the unused balance.

- 15 to 20 days later your bank notifies you that their check was returned as a fraudulent check

- By that time you have already shipped the item and sent out your good check for the unused balance.

- Your bank will not credit the amount back to your account and the fraudster has disappeared.

Tips to avoid being a victim:

- Question all inquiries

- Don’t take up any offers for more than the listed sale price

- Don’t agree to ship the item to them. Ask them to pick up.

- If your buyer is coming to your location, ask them to bring cash. No checks or official checks

- If you do get a check, try to verify if the check is good by calling the bank or the issuing agent. Most banks won’t tell you, but if it is a bank issued check, you can ask them specific questions regarding the color or other distinctive qualities. If it is from another issuing agent, they should advise you if the check is good.

- If you don’t get anywhere with #3 or 5, then tell the Buyer that won’t ship or return the funds until 30 days later for clearance of the check.

Here are two check fraud schemes that I can absolutely confirm, as I have all the proof:

➽ My father passed away in 2017 and although he was a man of simple tastes and not an accumulator of personal belongings, there was still a lot to go through with decisions to be made to keep, donate or sell. The disposition of his furniture was particularly difficult; items were large and not many were interested in traditional style pieces.

One of this was his china cabinet which he used to display knick knacks and mementos gathered through the course of his life. My siblings and I decided that we would advertise it on a popular merchandise sale site and hope that someone would be interested.

To our surprise, there was an immediate interest and although the item was selling for $600, the inquirer, through e-mail messages, sounded definitely interested and willing to pay. In fact, he was hoping to reserve the item by offering to add another $30 to the asking price. Very pleased I took his cell number, which had an area code in a nearby area, and gave him mine.

Through text messages he advised me that he was going to overnight a check for $2,500 to us, to cover the cost of the item, the additional reservation amount and the balance, he said, was for shipping the item to him.

He would give us his shipping company information and once the check cleared, could we make arrangements to ship and send him back the extra unused funds? We certainly agreed.

In the course of 3 days I received numerous texts asking whether I received his check, whether I deposited it, that he could walk me through the deposit, it would clear overnight, no stress, no problem!

It read like he really wanted the piece of furniture. Wow! That was fast and easy! This merchandise sale venue is my new best friend!

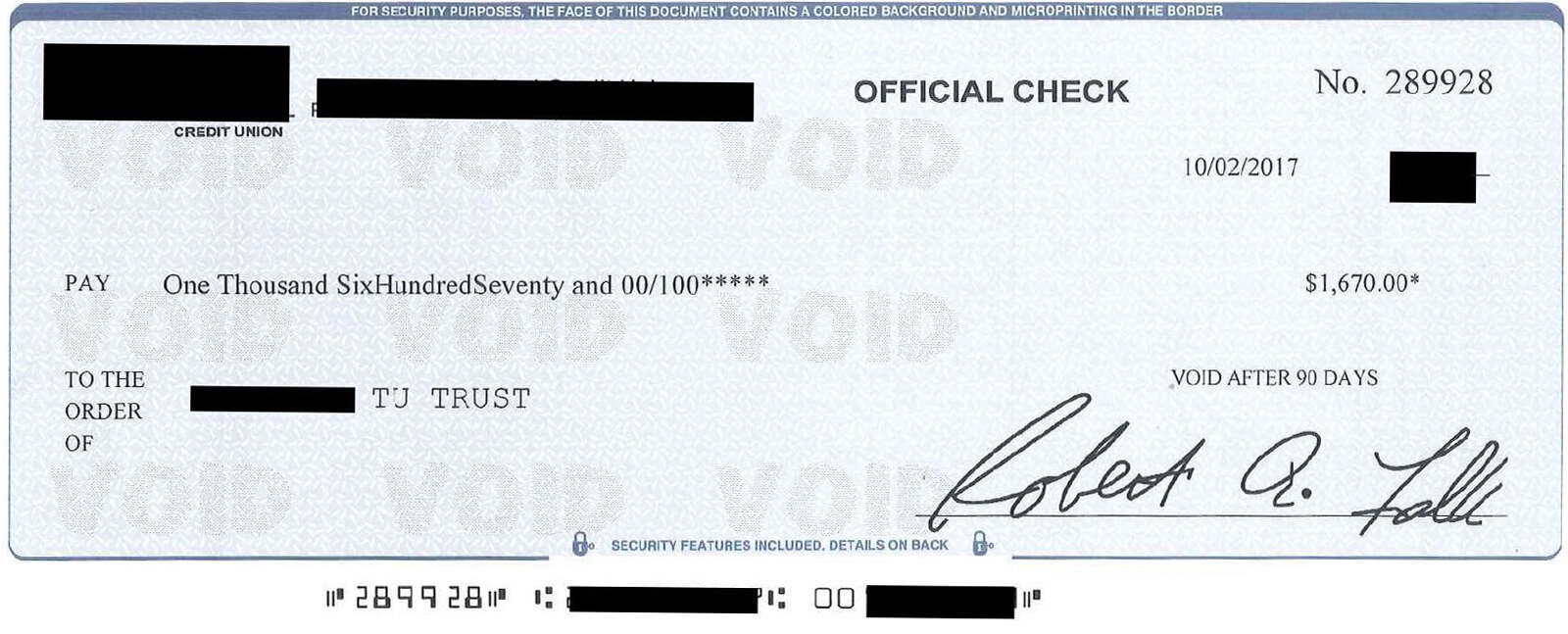

When the check did arrive I noticed that the overnight envelope was from an address in New York, the check was an “Official Check” drawn on a credit union in Idaho, and there was no mention of shipping information. What? My escrow- officer- on- the- lookout- for-fraud antenna went up and the first thing I did was call that credit union in Idaho.

Due to privacy issues the person at the credit union was not able to give any information as to whether this Official Check drawn on their bank was good or bad. Concerned, I argued that an Official Check was a check purchased from the bank, like a Cashiers Check, and surely they could tell me if that check number was good?

I could not get the information. I asked her a general question: the check that I received was blue; could she tell me if their checks were that color? No, she said, their Official Checks were green. She did volunteer the information that their checks had their phone number imprinted right below their address, which my check did not.

I guess by now you all know that I had a fraudulent check on my hands. I immediately texted the person and told him of my findings and that passing a fraudulent check was a felony and I would report this incident to the local authorities, D.A.’s office and the FBI. All of a sudden, I received nothing more from this fraudster.

Angry? Yes, that we were, what a waste of time! But more so, we were curious. How did he think he would profit by this? Once the check tried to clear and it bounces back his game would be up, right? Not so. I learned that this was a very prevalent scam that was perpetrated on the unsuspecting and naïve public, so much so that banks teach their staff to look out for this specifically.

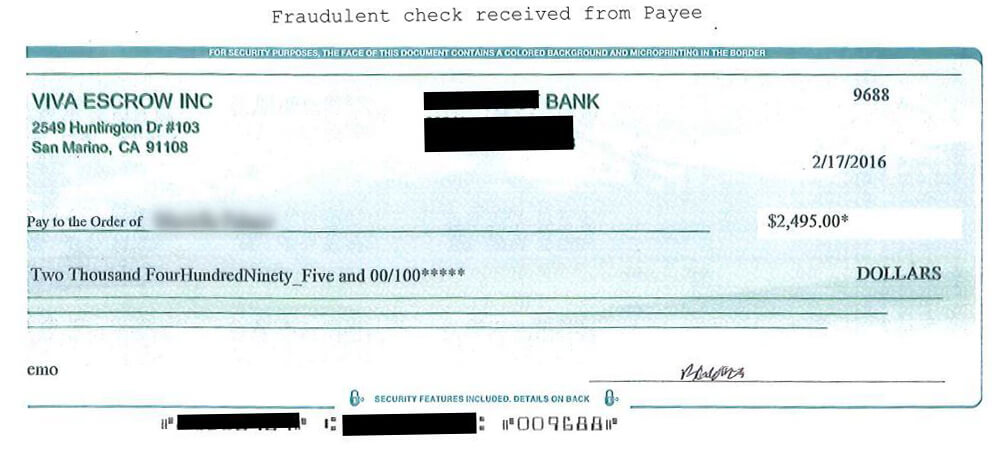

➽ Looking back I realized that this exact same type of incident happened a couple of years ago, in which our company was unwittingly made a part of a potential check fraud.

A person out in the Midwest was the targeted victim. She was also selling a piece of furniture. She was sent repeat emails, absolutely the same scenario that I had encountered. The check she received overnight was a fake check with our company name, drawn on our bank and bank account number. Questioning the validity, she was savvy enough to call us and send us a copy of what she received. We confirmed that the check did not look anything like our checks and that we had never issued it.

Here is the standard modus operandi:

- The check is not a personal check, it usually comes as a bank check or drawn on an entity.

- The unsuspecting victim deposits the check and, if they are more cautious, gives it the normal five days (by law) to clear the item.

- After the time period has passed the victim then ships the item and returns the balance to the fraudster.

- Unfortunately, and here is the crux of the matter, fraudulent checks, take 15 – 20 days to come back to the depositing bank. When the fraudulent check does come back as an uncollectable item, the original deposit amount is taken out from the victim’s account.

- The victim has been conned out of the amount they sent back to the fraudster and, of course, the item they were selling. The bank will not honor any claim.

Fraud comes in many forms; it doesn’t have to be a wire fraud of hundreds of thousands of dollars from an escrow trust account, which is much harder to plan and perpetrate.

These every day check fraud of $1,000 dollars here and $1,200 dollars there on the unsuspecting public is much more common and much easier to organize. The law agencies may not have the resources keep up but education of the public would be a step in the right direction.

Perhaps the FTC and the banking/financial institutions could take a more active role in preventing fraud by letting the public and their customers know and by putting in place procedures that would allow the release of pertinent check information when requested.

I still have a china cabinet for sale. Interested? Price reduced and we will take wires or PayPal!

This is Juliana from Viva Escrow and I am here to keep you posted!

Juliana Tu, CSEO, CEO, CBSS, CEI, SASIP

Escrow Manager

Good news! “The Art of Escrow” is out! Look for it on www.amazon.com!

The Art of Escrow:

The Fight For Your American Dream and the Pursuit of Homeownership

Available now at Amazon.com

- Threats to Escrow – Part 5 – Document Fraud! - May 19, 2023

- When the Loan Got Sold and You Just Closed Escrow - April 6, 2020

- Mechanics Lien - October 7, 2019

- Are You a Foreigner and Need to Know About U.S. FIRPTA Withholding Laws? - February 20, 2019

- When the FIRPTA

Withholding Goes Wrong - February 20, 2019

Join Our FREE Viva Escrow Forums